Below is the explanation as to how it works.

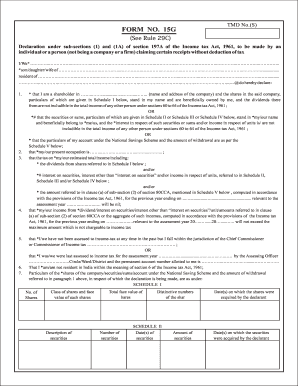

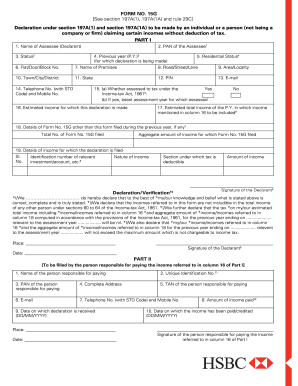

PAN Application Form 49A in excel format Form 49 A is required to be submitted to the income tax department to get a PAN number for individual.A sample of form 16 and form 16A both types of forms can be downloaded from the link provided in the below table in excel and word format as required Specimen Of Form 16 & Form 16a Free Download In Excel and word format The service provider – in turn – submits this to the income tax department while filing his income tax returns. To this effect, the organization, which has availed of the service, issues a certificate which consists of the Tax Thus Deducted (Which is also called as TDS or Tax Deducted at Source) to the service provider. Upon completion of this procedure, the service seeking organization deposits the tax thus deducted into the government treasury. In plain simple terms, Form – 16A is a form, which is provided by any organization that has obtained any form of services (Such as consultancy services etc.) From a particular vendor, and when the service provider invoices the service seeking organization, then the organization (That is the service seeking organization) deducts Tax, as per the taxation laws. On the other hand Form – 16A is issued by every person deducting tax, to the person whose tax has been deducted for every month or for a full financial year. Essentially, Form – 16 is a TDS (Tax Deducted At Source) Certificate issued by the employer to the employee. The salary paid employee files her / his annual returns to the Income Tax Department, by submitting this form. If you are an employee of any organization, which means you are on any of the company’s payroll, you should receive your Form 16 by April 30 every year.

It is nothing but a certificate issued by an employer to an employee providing complete details of the Salaries & Wages earned, and the Exemptions and deductions applicable to the employee based on her / his salary structure as well as on the tax-deductible / tax-exemptible investments.

Form – 16 as we all know it is one of the most important forms, and is regularly used by us.

0 kommentar(er)

0 kommentar(er)